I want to create a guide that explains the infinite banking concept basics for those that aren’t familiar with it. You may be wondering if there will be an advanced guide and the short answer is no simply because utilizing any policy is so situational to the individual. There will be use cases and theory posts, later on, to help you better understand what to do with your own policy. For now, let’s discuss the concepts of infinite banking.

Let me pose a couple of questions: if you could keep your money AND buy an asset would you want to know more? If you could keep your money, buy an asset, earn interest on your money, and maybe even from the asset, how many times would you do that?

The infinite banking concept guide

The concept of infinite banking was established by Nelson Nashes’ book “Become Your Own Banker”. There have been several other books that put their own spin on explaining the concept that helps one audience or another understand it. Basically speaking they all describe the same thing: use the cash value in a life insurance policy to grow your money.

Now to start with the infinite banking concept uses a whole life insurance policy WITH specific riders to optimize the growth of the cash value within it. As a caveat Id like to say that standard whole life without these riders is not recommended because it’s essentially just really expensive term insurance. So, with that out of the way how do these riders work?

Think of this policy as a flow-through entity. Right now you earn money and it goes into your bank account and then you take money out to buy or pay for things. Using this concept you’ll simply add 1 extra step. Money goes into your bank account, then you put it into the policy and then buy things.

Nelson Nash used the example of buying cars every so many years for the purpose of being able to stuff more money into the policy and compound its interest-earning potential of it. So it acts kind of like a bank account, sort of like your 401k, and other investment accounts in certain respects.

OK so let’s say you have a chunk of change in the policy.. be it 10 grand or 10 million doesn’t matter. Cash value builds at a guaranteed amount over time as shown in the illustration you receive. You can increase the growth by loaning against the policy. I know this is an odd idea for those just hearing about it but hold on and keep reading.

OK, so theirs that money in the account, and instead of taking money literally out of the policy like you do with your bank account or a 401k for say a home purchase, instead of it’s like you put a lien against the policy that is paid back at your death if not before. OK think about this for a 2nd. The insurance company sends you the amount you requested, leaves the money in your account to continue earning interest, and guaranteed interest, and lets you pay the loan back to yourself and in doing so pay yourself instead of paying a bank or other lending institution.

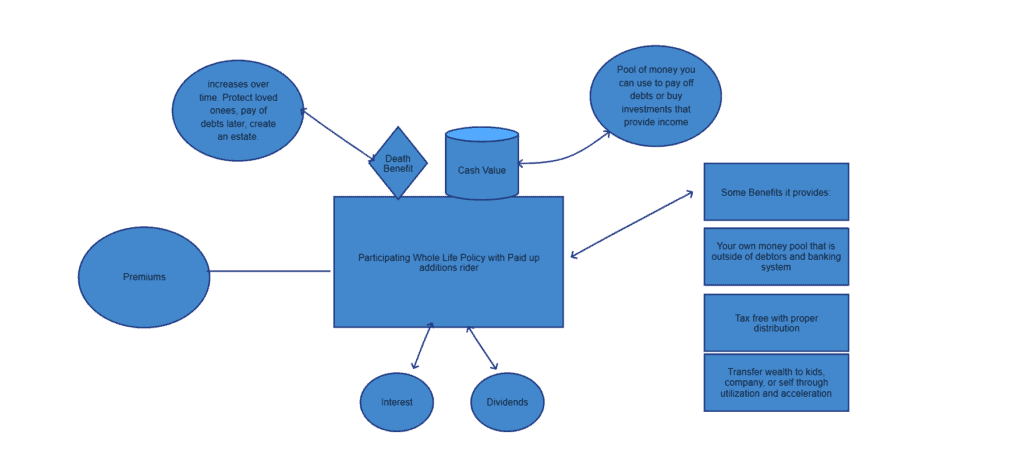

All the time we hear from wealthy people that acceleration or leveraging money is the way to build wealth and this is one way that they do that, you can as well. So let me show you a graphic of the parts that make up an infinite banking policy to show you how it works.

Infinite banking concept pros and cons

there are two infinite banking concept cons that I would mention:

- price of the policies

- who do you get them from

The price of a whole life insurance policy is considerably higher than that of a term insurance product that offers far more options with the living benefits. This is not to say don’t get it because of the price rather look more at how you plan to utilize it. If all you want is death protection then the term may be a better option.

Who you go to for an illustration is probably the biggest factor in how well the policy will perform. If you get someone more concerned with their commission then you may not see cash value build for 3 or more years. Instead what I like to do is recommend a policy where we maximize the cash value building portion and reduce the policy costs as much as possible many times allowing you to have considerable cash value in year 1.

Infinite banking concept pros

- Accelerate growth through utilization

- maintain control of your money

These are just some of the benefits that you can get from an infinite banking policy as you see in the image above there are others listed. By taking policy loans you can create a snowball effect on the growth of the money in your policy.

I once heard how risk is like a set of straws in your hand where ownership is just one of those straws. Each straw has its variation of control and associated risks. Some others are lease, rent, owner finance, etc. The more control you have over the money you earn and the more times you are able to use it the more growth you are going to create over time.

Summary

Put simply the infinite banking concept is a method that allows you to retain control of your money and use it over and over again. Through the use of a participating whole life insurance product with paid-up additions you can grow your money many times more than you can with other traditional methods.