I think we are all the same so I know you want to get the most out of your money. Though, have you really looked into where your money is going and asked who is actually getting the most out of your money? Let’s look at some statistics and information to get a clearer idea of how you can get more from your hard-earned money.

Where is your money going

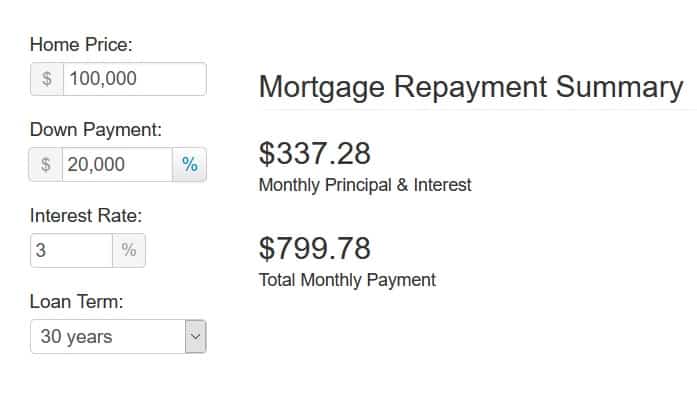

Interest payments for credit card debt, student loan debt, and other personal loans eat up a lot of the money that you earn. Even if you are investing, chances are that much of what you are earning is offset by the payments you are making on debt servicing or it could be far better if you put your money to work better. Let’s look at a mortgage repayment example and see just whos getting the most from it.

As you can see you are getting roughly $300 worth of principle paid off while you are paying nearly $500 in interest. While the interest rate stated on the purchase is 3%, your actual interest payment is well over 50% for over a decade if not two for most mortgage loans. (check an amortization calculator like this one here). This example alone shows how most of us put more money to work for others than we do for ourselves.

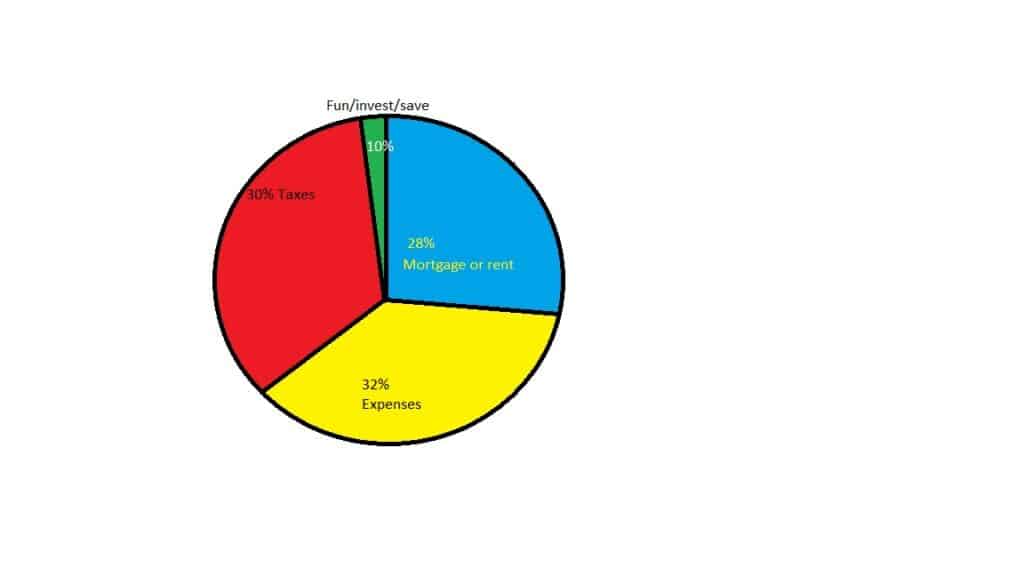

The pie chart below is how most people’s finances usually are. The percentages might be a bit higher or lower in the areas for you but generally speaking, things look something like this.

30% in taxes, 32% in expenses other than mortgage or rent which is often calculated somewhere around 28% of your income. This leaves only 10% roughly to put towards savings, retirement, and investing. The slice of the pie is so small it’s almost as if it doesn’t exist, and in fact, for many, it actually doesn’t.

The taxes side includes all the tax payments you may make including sales tax, income tax, etc. Expenses are things such as gas, food, credit cards, student loans, car loans, etc. Keep in mind the above portions are going towards KNOWN expenses.

This is partly why it’s so hard for many to increase their savings or investing because things that break down or come up unexpectedly have to come out of the money that’s being used to create that cushion of savings or investment purchase.

The federal reserve survey of consumer finances shows that the average retirement savings are $65,000. That’s not a whole lot of money to be retiring on if you ask me. What’s more think of the changes in cost over the years on goods and services. Let’s look at gas prices just for kicks.

| 1981 | 1.35 |

| 1990 | 1.2 |

| 2000 | 1.56 |

| 2005 | 2.38 |

| 2010 | 2.83 |

| 2012 | 3.69 |

| 2015 | 2.51 |

| 2017 | 2.46 |

I was born in 1981 so I used that as a start number for myself mostly. I arbitrarily picked some different years for the chart. If you want more years you can go to the Usinflation calculator for more. While gas has been sort of fluctuating in these years it has steadily risen to require more of your money to be allocated to it and this is just one area of expense.

Where ELSE is your money going?

Aside from these money leaks above, how well do you track the money you spend? Some time ago my older brother, who was a truck driver at the time, said he and his wife kept fighting over money wondering where it had gone. They finally started looking at their bank account more carefully and found that they were spending nearly $800 a month on fast food. Sure it’s convenient and perhaps it tastes good but you can buy a lot of groceries for that, which is what they started doing.

How many other areas of your life might something similar be going on? Do you spend a lot on entertainment be it books, video games, movies, or going out and don’t really track or budget for it? If so these could be reasons why you struggle, are frustrated, or don’t have the kind of savings you would like to put towards improving your financial situation (I’d like to say that I’m a proponent of increasing your income more than trying to be frugal, stingy, or anything like that. I’m simply recommending a more conscious awareness of how you are spending without being overly nit-picky about making a purchase).

I know I have said, “I’m going to start saving more money” or “I’m going to start investing” and yet I put it off longer than desired for one reason or another (alright mostly it was just feeling overwhelmed or plain laziness). What I’ve found is that while we say we are going to do something the hardest part is actually getting ourselves to DO it. So this is where an automated process comes in super helpful. Automatic deposits to a separate bank account for savings, retirement, or whatever else you want to get started with will help tremendously.

How to get the most out of your money

Ok, so we’ve looked at how the money we are earning is not benefiting as much as it is others. So how then do we change things to get more from what we are earning.

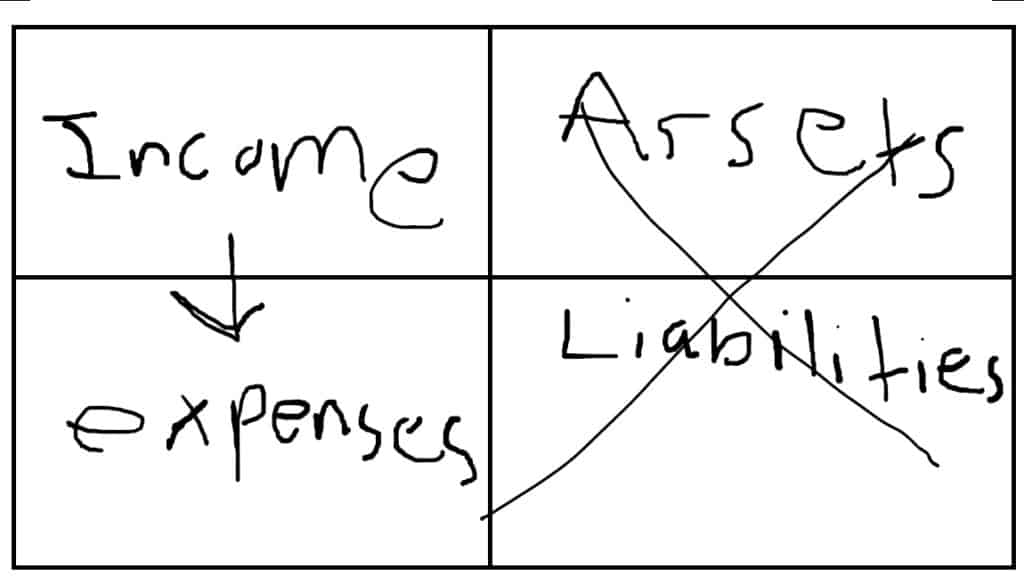

To answer that let’s look first at what I like to think of as the flow of money.

We all do this at some point in our life. We essentially reduce our finances to nothing more than income and expenses. To get more out of your money you need to start doing the following:

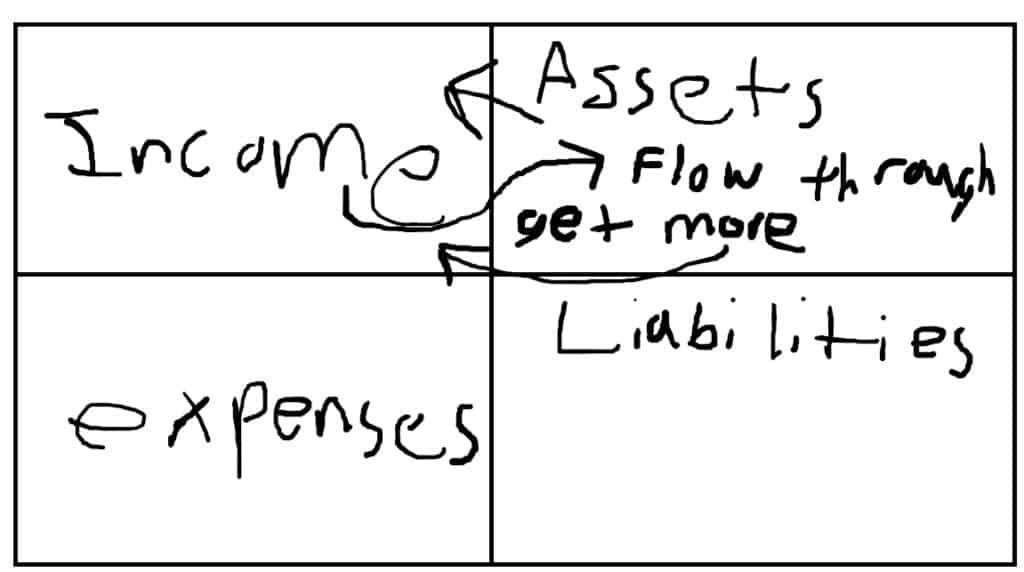

Robert Kiyosaki in his book Rich Dad Poor Dad describes an asset as something that puts money in your pocket and liability as something that takes money out. There are many kinds of assets that can be used to create income.

Here are some things you can do to get the most out of your money to make money

- Build a website

- Grow a YouTube channel

- Write books for Amazon and/or your website

- Do surveys

- Buy and sell used stuff around your town

The thing the above items have in common is that they require more personal time than they do capital to do. The following require more capital to do than time, though it doesn’t have to be your own capital.

- Real estate

- Business

- Franchises

Now while all of these things can create additional income and reduce your money problems more than simply trying to save or get out of debt can. To get the most out of your money faster you can use an insurance product that acts as a flow throw option that will allow you to pay yourself twice so to speak.

This is what many of the wealthy, banks and other companies use to accelerate the use of the money they earn to create much better returns. Its usually referred to as the infinite banking concept. If you haven’t heard much about it look at my basic guide to learn more.

Fix some of your money problems with this simple guide on budgeting

Summary

Let’s recap real fast here. If you are like me then you want to get the most of your money but have been finding it tough to change your financial situation. With some research, you may have found that your viewpoint on money has all been a lie and is the actual problem keeping you stuck in the rut of going to work and paying your bills without actually solving the money worries you have like you have been led to believe it will.

So to change your finances you first need to change the ideas you have about money (like reading this article) and then do something different. That doesn’t mean you have to quit what you are doing work-wise, especially if you like it. What it will require is adding something more to your financial game plan which may be nothing more than a policy that lets you use your money twice.